The most direct solution to our national housing crisis is to call an immediate halt to our cruel housing musical chairs game, which sees only one of every four people with incomes low enough to qualify for federal housing subsidy getting any assistance at all. Because we have refused to properly fund our U.S. housing programs, the unlucky 75% are forced to spend half of their income or even more on market-rate housing. These 14 million households engage in a perpetually shaky arrangement that collapses into chaos when a car breaks down, an expensive prescription needs to be filled, or work shifts are missed because a child gets sick.

In the Indianapolis eviction court where our law school clinic works, the losers of the musical chairs game line up in front of the judge every week, waiting to hear what day they will be ordered to move from their homes. They are among the ten million people in the U.S. that are behind on their rent, a number that disproportionately includes mothers with young children, especially Black women, seniors, and persons with disabilities.

Scenes like this are unthinkable in the many other nations where all who qualify for housing assistance receive it. Even in the U.S., this does not happen in areas like Medicaid and SNAP (food stamps), where eligibility equals an entitlement to receive the benefit. That contrast is on ironic display outside the courtroom where we work, where a worker funded by government dollars sits behind a table and colorful signs, inviting the people getting evicted to sign up for our state’s version of Medicaid.

But housing is not cheap. Ensuring that all in need are safely housed will cost money. Is it even possible for the U.S. government to afford the cost of making housing a fully-realized human right?

In a word, yes.

We know we can do this because our government already devotes tens of billions of dollars to subsidize housing, more than enough to ensure a home for those who need it the most. The problem is that we devote most of that housing money to the benefit of those who need it the least.

This article introduces the overflowing cornucopia of benefits the United States provides to wealthy landlords and homeowners, mostly through what housing expert Alex Schwartz calls “tax expenditures.” Our government provides a boatload of loopholes and tax breaks that allow the wealthiest landlords and homeowners to make billions from housing while their neighbors are homeless or barely hang on to a rented unit. With housing far and away the largest cost for most households, this contrast between how we treat landlords and tenants is a big contributor to the fact that the highest-income 1% in the U.S. are now wealthier than they have been at any time in the past 80 years.

Beyond pulling back the curtain on our shameful approach to housing funding, this article will also outline the ways we can and should fix things. Two special shout-outs of appreciation: First, to my wonderful son Sam Quigley, who helped write Tax the Rich! How Lies, Loopholes, and Lobbyists Make the Rich Even Richer, and his colleagues at Patriotic Millionaires, who have taught me and many others so much about the injustice in our tax system. Thanks also to the good people of the Center on Budget and Policy Priorities, who publish extensive research and advocacy publications on tax policy, and also generously provided direct advice for this article.

* * *

California billionaire Geoffrey Palmer explained in a 2015 interview why he chose to focus his business on real estate: “Quite simply, I don’t like paying taxes!”

Palmer chose wisely. In that same interview, he claimed that his firm had not paid federal taxes in 30 years. A better-known real estate billionaire, Donald Trump, also avoided paying any federal taxes for most of the years that have been examined by the New York Times . Consider also Stephen Ross, a former tax lawyer who became one of the 250 richest people in the world and owner of the Miami Dolphins football team. Ross made $1.5 billion in real estate income from 2008 to 2017 yet did not pay a penny in federal income tax over those years. “If you’re looking to get richer while telling the tax man you’re getting poorer, it’s hard to beat real estate development,” concluded a 2021 Pro Publica report on Ross’s and others’ tax avoidance.

How does our government allow this to happen? To break down the process, we will examine the enormous tax gifts provided to landlords in the context of a hypothetical couple, Steve and Sally Slumlordz. We’ll say the Slumlordz own a multifamily residential housing complex, Dilapadia, which was worth $10 million when they took out a loan to purchase it.

Pass-Throughs. First of all, the Slumlords do not own Dilapadia in their own names. Instead, their accountant and attorney have set them up with a limited liability corporation, LLC, that holds the title to Dilapadia. Most multifamily real estate is owned in an arrangement such as an LLC, partnership or S corporation. Those arrangements provide the Slumlords with the benefits of corporate protection, meaning that they usually can’t be held personally responsible for the business’s debts. Yet they also allow the rental income from the entity to “pass through” to the Slumlordz or other beneficiaries personally, without any assessment of the corporate income tax that is charged against other forms of corporations.

Getting to avoid both corporate tax and personally liability is already a huge gift to the Slumlordz. But the breaks are just getting started, because they are also allowed to deduct 20% of Dilapadia’s pass-through income each year. Similar pass-through benefits are provided to Real Estate Investment Trusts, REITS, which distribute their income to shareholders. Huge hedge funds and private equity firms like Blackstone have taken advantage of these loopholes to create REITS that now own over a million U.S. rental units, including an increasing number of single-family homes.

The pass-through income deduction is estimated to provide $50 billion worth of benefits each year, almost solely to the richest among us. These benefits are what Schwartz and others mean when they refer to “tax expenditures”: the government does not write a check to the Slumlordz, but the government goes without money that otherwise would be owed. Over 60% of the pass-through deduction’s benefits go to the top 1% wealthiest Americans, according to the Congressional Joint Committee on Taxation.

Neither Tammy Tenant, who lives at Dilapadia, nor Maggie Manager, who works there, get any such break on the taxes they pay they make from their hard work. But the Slumlordz get these benefits on their “passive income”: money they make just for sitting around as owners. Little wonder that the former chief of staff of the Joint Committee on Taxation, Edward Kleinbard, calls the pass-through deduction the “worst tax idea ever . . . (it) simply excuses the affluent from taxes imposed on the rest of us.”

Depreciation and Tycoon Love. “I love depreciation,” Donald Trump admitted during a 2016 Presidential debate. No wonder. It is one of the most impactful tax breaks that Trump and other real estate tycoons are gifted with. Trump’s fellow real estate tycoon Geoffrey Palmer attributes his three decades of tax avoidance to “the magic of depreciation.”

It is a magic trick that benefits the Slumlordz as well. In addition to the 20% pass-through deduction they receive, they also get to deduct the $10 million cost of Dilapadia in proportional amounts over the course of 27.5 years. That is the period tax during which the law says a multifamily residential building depreciates down to zero value. So the Slumlordz get to make an automatic $362,000 deduction from their taxable income each year. They also get to deduct the cost of doing business, like the fees paid to the accountants and lawyers that set up their LLC, Maggie Manager’s and others’ salaries, maintenance costs, etc. And they can depreciate the cost of capital improvements to Dilapadia, such as a new roof. (Although the Slumlordz don’t make many improvements to Dilapadia, TBH. Hence the name.)

Of course, Dilapadia’s value after 27 years is clearly not zero. In fact, its worth is likely to have increased a great deal, since that has been the case for most multifamily housing in the U.S. So, if and when they sell Dilapadia, the Slumlordz would in theory owe taxes on the difference between the sale price and the depreciated value. This is called “recapture” of the depreciation benefits provided over the years: if the Slumlordz sell for $20 million and they have taken all their depreciation, the “recapture” would mean they own taxes on that $20 million. But, spoiler alert: our tax laws have provided the Slumlordz with ways they can avoid this recapture, too.

Image by 401kcalculator.org CC By-ND 2.0

Capital Gains and “Voluntary” Taxes. Both the increase in the value of Dilapadia and the pass-through income from it are classified as capital gains. Wealthy people like the Slumlordz make most of their income through sources like capital gains and other forms of pass-throughs. But most of us working stiffs never see much or any capital gains in our bank accounts: nearly 70% of capital gains in the U.S. are received by the top 1%.

The scope of the benefits our tax laws provide wealthy people with capital gains income is breathtaking. First of all, their investment income is taxed at a lower rate than the equivalent amount of employment income, again rewarding the Slumlordz for making money passively while penalizing Tammy and Maggie for earning their money via hard work. Second, capital gains from the increase in Dilapadia’s value is not taxed at the time it occurs: the Slumlordz pay taxes on their gains only if and when they sell the property. That means there is a huge amount of untaxed wealth sitting around in this country. Capital gains that have not yet been taxed make up over one-third of the assets of the wealthiest 1% of U.S. households.

So the Slumlordz can choose an opportune time to sell. For example, they can sell during a year when they have capital losses to offset the gains, thus reducing or even eliminating any tax bill. Those of us who pay taxes on our working income are so fortunate. Consider the IRS’s reaction if Tammy or Maggie announced, “I choose to delay paying my payroll taxes for the foreseeable future, thank you very much.”

Finally, and best of all for the Slumlordz, there are easy ways to not just delay paying capital gains taxes, but to avoid them altogether. So easy, in fact, that the Center on Budget and Policy Priorities calls capital gains taxes “effectively voluntary.” We will review some of the paths to capital gains tax avoidance below.

Buy, Borrow, Die: Tax-Free Cash to Spend. We know that Dilapadia likely increases in value even as the Slumlordz get to claim depreciation deductions each year. But, without selling Dilapadia, those increases are just paper figures which provide no immediate benefit to the Slumlordz. Right? Wrong. Not only can the Slumlordz borrow money against Dilapadia’s increased worth, the loan proceeds are not counted as taxable income. The Slumlordz even get to deduct the costs of securing that loan, plus the interest they pay on it.

Real estate pros call this “the harvest.” It is stage two of the real estate tax avoidance strategy known as Buy, Borrow, Die. (More about the final-act stage three later.)

One real estate tax advisor who enthusiastically touts the benefits of this cash-by-borrowing approach admits the quiet part out loud: Tammy Tenant, of all people, will foot the bill for the Slumlordz. “Over time, your tenants pay the loan off for you. You get to keep the property, which hopefully keeps appreciating for you, and the rents rise with time, even as your mortgage payment remains fixed . . .And when you pay off the loan in full, guess what? You can turn around and do it all over again, borrowing more cash against your property and letting your tenants pay that loan off, too.”

As one real estate joke has it, “I must be rich, because I owe millions.” Those millions can and do pay for lavish lifestyles for landlords, funded by their tenants and other taxpayers.

Home Cooking with State and Local Tax Breaks and Funding. Maggie Manager purchased a two-bedroom bungalow a few years ago. Each year, she receives a bill for property taxes she owes. Those taxes, which help pay for local schools, public safety, and road maintenance, are based on the value of Maggie’s home. But her bosses may well not pay the same rate.

The Slumlordz property tax bill for Dilapadia may be reduced by abatements or PILOTs (Payment In Lieu of Taxes) provided by local government in return for promising to develop or improve property. For example, the City of New York’s 421a program provided $1.7 billion per year in tax abatements for developers and owners, more than the city spent on low-income housing. Another example: the massive REIT Mid-America Apartment Community, whose 100,000-plus units make it one of the largest landlords in the nation, received $3.8 million in tax-increment financing (TIF) subsidies for Texas projects. The Lincoln Institute for Land Policy estimates that property tax incentives for businesses cost local governments as much as $10 billion each year.

It is not surprising that property owners like the Slumlordz are extremely successful in negotiating down their local tax obligations and wrangling subsidies from state and local governments. After all, they can hire the best lobbyists and attorneys to advocate for them—and then deduct those professionals’ bills from their tax obligations. Poor Maggie can’t compete with that. But someone needs to pay for the fire trucks.

Being Rich and Owning a Home. The Slumlordz own two homes, a mansion in Poshville and a beach house on Sandy Acres. That means they get tax breaks that their Dilapadia renters like Tammy Tenant do not. The Slumlordz can claim a deduction on the mortgage interest they pay on both homes on loans up to $750,000. They can deduct the property taxes they pay up to $10,000, and they can sell the homes without paying capital gains on amounts up to a half-million dollars. Together, these tax breaks benefit homeowners more than $65 billion each year, reflecting at least a 2 to 1 ratio of government benefits provided to homeowners versus support for renters.

In theory, since Maggie Manager owns her own home, she can benefit from these tax breaks, too. But, like most people with incomes below $200,000, she is unlikely to claim itemized deductions. That means the benefits of the mortgage interest and property tax deductions are largely raked in by the wealthiest 20% of households.

That is the reason that housing experts have concluded that the mortgage interest deduction does not effectively incentivize homeownership, especially for first-time home buyers. Instead, it only encourages already-wealthy people like the Slumlordz to buy more expensive homes.

Zones of Opportunity—for the Rich. The 2017 Tax Cuts and Jobs Act was a bonanza for landlords. In addition to preserving previous real estate tax breaks like depreciation and pass-throughs, the TCJA gifted real estate investors with a new path to avoiding capital gains taxes: opportunity zones.

The pitch for the opportunity zones scheme sounds great. It incentivizes investors like the Slumlordz to take capital gains earned from the sale of property like Dilapadia and invest them in areas where the community has significant needs for development. Senator Tim Scott of South Carolina, who promoted the legislation, claims the program “provides needy communities with a new tool and a level playing field when competing for investment . . . Opportunity Zones are already credited with spurring economic development, job creation, revitalization, and new opportunities for countless Americans.”

The tax breaks for the Slumlordz are enormous: if they keep their investments in the zones in place for 10 years, they get a permanent exemption from all the capital gains they make on those investments. Even if they hold the investment for a shorter time, they still get tax deferrals or reductions. The Joint Committee on Taxation estimates that opportunity zones will cut these investors’ tax burdens by $3.5 billion a year.

But the devilish details show that this is not government money well-spent. The definition of what areas count as opportunity zones is far too broad, and the guidelines for who benefits from the investments are far too loose. Not-so-low income areas can receive opportunity zone-qualifying investments, and even investments in truly low-income areas may be subsidizing gentrification rather than helping the current residents in need. Under the opportunity zones scheme, untaxed money is being spent on expensive hotels and high-rent apartment buildings, student housing at elite universities, and even luxury condominiums at a superyacht marina.

This program provides a lot of attractive tax-avoidance options for the Slumlordz, but not a lot of benefit to those in need. As Samantha Jacoby of the Center on Budget and Policy Priorities has written in her analysis of opportunity zones, “The direct tax benefits of opportunity zones will flow overwhelmingly to wealthy investors, but the tax break might not do much to help low-income communities, and it could even harm some current residents of such communities.”

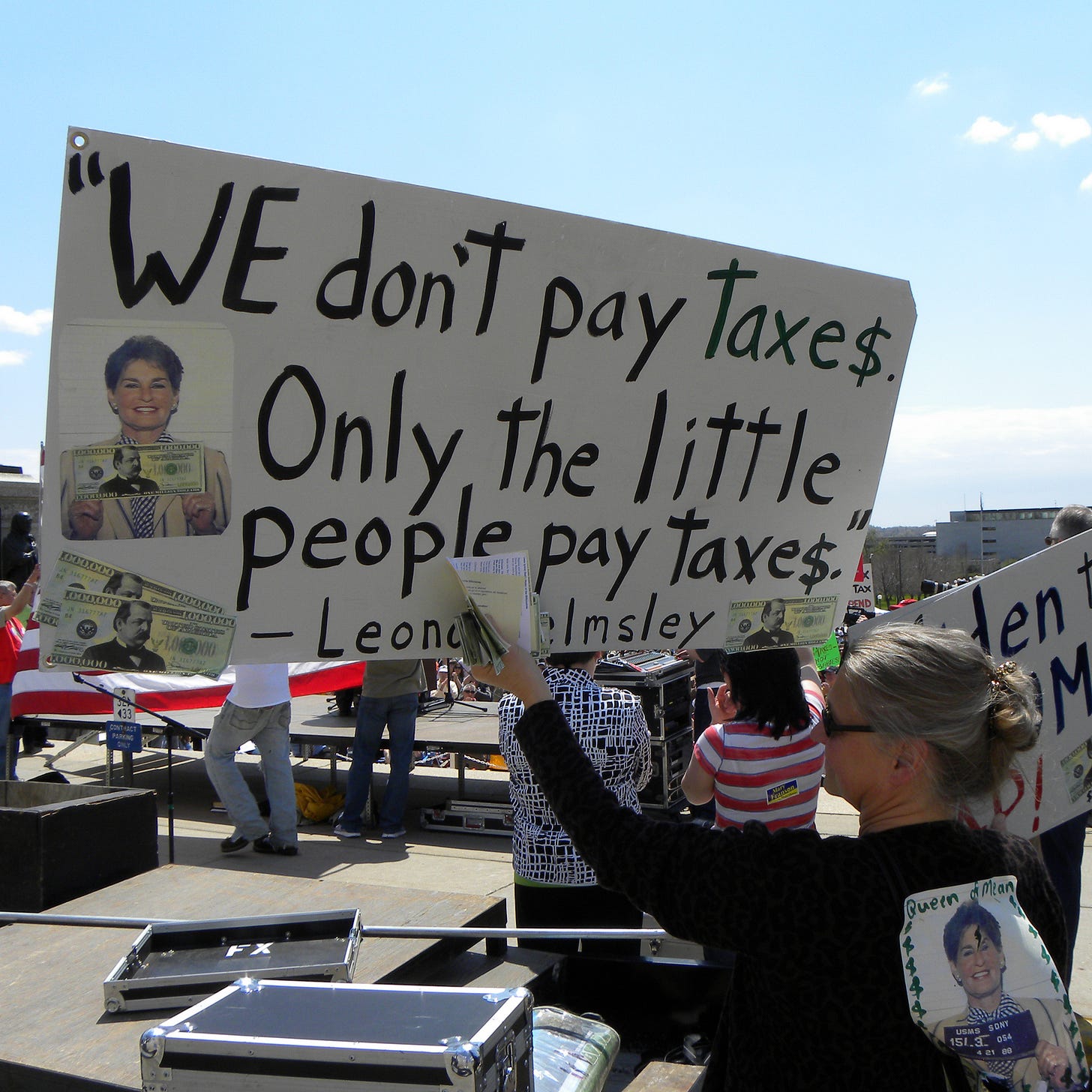

Image by Fibonacci Blue CC By-ND 2.0

Like-Kind of a Scam—1031 Exchanges. The 2017 TCJA was not all good news for rich people. It closed a loophole that had allowed individuals and firms to avoid taxes on the sale of assets by using the sale proceeds to buy something similar, such as selling one antique car and buying another. But when shutting off this practice, the TCJA preserved a single form of this “like-kind” or 1031, exchange. You guessed it: commercial real estate.

That means the Slumlordz can still sell Dilapadia for a net profit and pay zero taxes on that profit if they use that money to buy another piece of real estate, say Dilapadia II, within six months. These exchanges can go on indefinitely, all while the Slumlordz take out loans against the properties’ value to assure them a generous cash flow.

Those like-kind exchange delays means the deferral of taxes owed—often on tens of millions of dollars in gained value—goes on indefinitely, too. These like-kind swaps benefit real estate investors and cost taxpayers in an amount estimated to be $10 billion each year.

Not Avoiding Death, But Still Avoiding Taxes: Stepped-Up Basis and Estate Tax Exemptions. Alas, the Slumlordz can delay paying taxes indefinitely, but they can’t live forever. Surely when they die their long-deferred taxes on their real estate gains will finally be collected, right? Nope. Enter stage three of the “Buy, Borrow, Die” tax-avoidance strategy.

Let’s say Dilapadia doubled in value from $10 million to $20 million during the Slumlordz ownership, a predictable increase in worth for multi-family housing. Remember that they avoided paying any taxes on that increase in value, since the assessment of those capital gains taxes does not occur until a sale happens. Now, as it turns out, the Slumlordz capital gains died with them, thanks to the “stepped-up basis” tax break.

For estate tax purposes, the value of Dilapadia is “stepped up” to its worth at the time of the Slumlordz deaths. All of the capital gains accrued during their lifetime are wiped out, so the estate does not owe any taxes on them. They disappear, never to be taxed. The stepped-up basis rule on capital gains benefits wealthy heirs in an amount as much as $53 billion each year.

Combined with the huge federal estate tax exemption of nearly $26 million for a couple like the Slumlordz, the Slumlordz heirs will take over full benefits of Dilapadia without paying a penny of tax. This happens a lot: less than one-tenth of 1% of estates own any federal tax at all.

With all these breaks to wealthy heirs, it should come as no surprise that as much as 60% of all wealth in the U.S. is inherited. A lot of those unearned riches come in the form of tax-protected real estate. While Tammy and Maggie pay taxes on the money they earn with their hard labor, the Slumlordz avoided taxes during their lifetime. And the Slumlordz Juniors will become rich the old-fashioned way: they inherit it. As Justin Miller, national wealth strategist at the investment banking company BNY Mellon, told the New York Times for a 2019 article on real estate tax breaks, “You’re almost allowing the creation of a royal class of families.”

How We Fix This.

As the Center on Budget and Policy Priorities flatly states, “much of the income of the well-off never appears on their tax returns.” So it is no wonder that the wealth of billionaires has skyrocketed even while evictions and emergency shelter requests are rising.

But these landlord tax breaks are the result of political choices, and those choices can be reconsidered. Along with the Center on Budget and Policy Priorities and Patriotic Millionaires, the Economic Policy Institute and others have long called for the repeal or major restructuring of the loopholes we have discussed here, including pass-through deductions, opportunity zones, stepped-up basis, like-kind exchanges, and estate tax exemptions. U.S. Senate Finance Committee Chair Ron Wyden has proposed a Billionaires Income Tax to terminate many of the tax avoidance schemes that benefit wealthy investors.

Beyond cutting back on tax breaks for wealthy landlords, advocates at the national and local levels like People’s Action and Center on Popular Democracy push to switch our approach completely: use tax policy to deter toxic real estate investor behavior and raise funds for affordable housing.

Among their proposals are to impose extra taxes on investors who buy housing not for much-needed shelter but instead for speculation purposes. We can impose a hefty charge on profits made from selling a home without making any capital improvements, and a flipping tax can charge for quick turnarounds by home purchasers. Blight/vacancy taxes and taxes on high-dollar real estate transactions are among the popular proposals that won approval from voters in the November 2022 elections, including the “mansion tax” Los Angeles voters imposed on high-dollar transactions.

At the federal level, multiple members of Congress have introduced the Stop Wall Street Landlords Act. This legislation would block wealthy investors from claiming some deductions on their ownership of single-family homes and impose a transfer tax on their purchase of single-family homes they are buying solely for investment purposes.

In tax policy, we get the behavior we reward. If we want to see housing as a fully-realized human right for all instead of a tool for windfall profits for a select few, we have to fix the tax policies that got us here.

This breaks my heart! Incredibly insightful! Thank you for sharing, Prof. Quigley!

This hurts my head. But the details are helpful in validating the “rich get richest” scheme.